If your company has employees, you have to pay your people. It’s that simple.

How you decide to pay them, however, is more complicated.

The fact that you’re reading this probably means you’re tired of all the manual payroll processing and you’re looking to automate the process.

Fortunately or unfortunately, there are seemingly endless payroll software for all types of small businesses that you can find in Singapore. So how do you figure out which is best for you?

First, let’s lay out the three key aspects to the process of “doing payroll:”

- Calculating the correct earnings for each employee (including things like overtime pay and bonus) and calculating the relevant taxes and other deductions (such as health care contributions) to be withheld from those earnings;

- Disbursing these payments to employees and setting aside the deducted amounts to be paid out to the appropriate recipients (IRAS, CPF, health care, retirement funds, etc); and

- Recordkeeping for each individual employee and for the business overall.

Why you need a payroll software for your small business

Whether you’re a small business or a large organization, the function of a payroll software is the same: documentation and automation.

The most obvious reason is that you need to pay people who work in your company. But a payroll system goes much further than paying employees. And the HR department knows that better than anyone else.

Documentation:

A payroll software can track who’s working for your company, how long they’ve worked for and how much you’re spending on labour.

Automation:

Of course an automated payroll system also ensures everyone’s paid on time. You don’t want to piss your employees off with late or inaccurate paychecks. Or get fined by the authorities for inaccurate taxes.

If you’re looking for an SME payroll system, here are the basic features to look out for:

- Tracks employee hours

- Computes employee wages

- Calculates deductions and other withholdings

- Keeps tax documents organized

- Tracks direct deposits and payments

You might be interested in: Are you making these payroll mistakes? Avoid them with a HRM software

Step 1: Find your Unique Entity Number

Assuming you’re a decently established your business with all the relevant licences…

- Find your UEN

- Start a bank account solely for payroll transactions (separate from your main business account)

Step 2: Establish your payroll process

Now, you will need to make some decisions on your cash outflow each period. You’ll need to invest time into determining what will work best for your business. Businesses that aren’t disciplined about a schedule run into the problem of last-minute frenzies and are more prone to calculation mistakes.

- Pay schedule: Will you pay weekly/ bi-weekly/ monthly? On which day?

- Types of employees (not contractors) you’ll have: Full-time vs Part-time, Exempt vs Non-exempt

- Tracking working hours: Will you need to track punch-in/punch-out time? If so, how will they report for work?

- Benefits: Will you have healthcare, insurance, cellphone, fitness, childcare benefits? How to manage the payroll deductions (if any)

- Taxes: When will your taxes be paid? How much?

- Payroll processes: Will you calculate and process with an external payroll service provider or get your own online payroll and accounting software?

- Paychecks: Will you be giving cheques or direct deposit into their bank account? Or maybe cash?

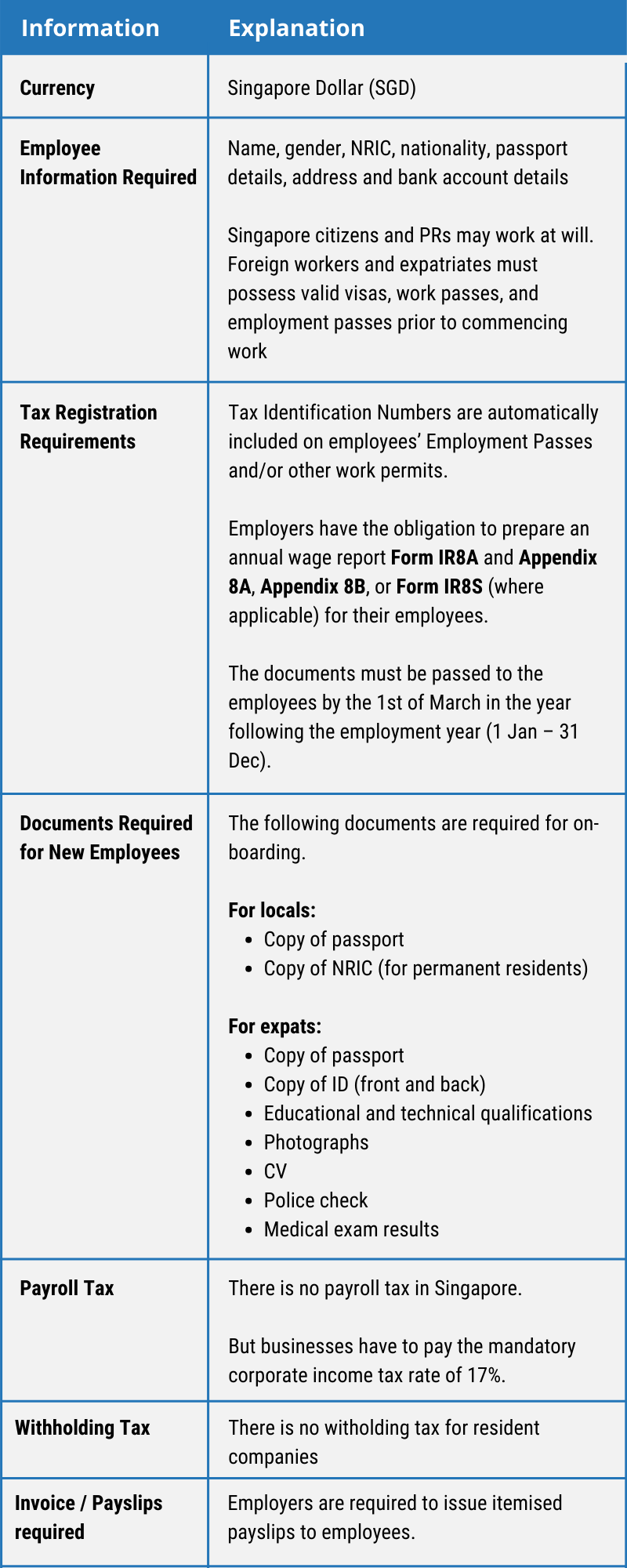

Step 3: Have every employee fill out payroll forms

Once your new employee is ready to start work, you need to collect some important payroll documents. These include contracts, tax and work authorization forms, which employees need to sign. They can be in hardcopy or softcopy.

Because this is so manpower heavy, especially for a small business, we’d recommend having all these stored neatly in the payroll section of your HRM software. This way, you can track systematically and retrieve documents easily when you need them.

Step 4: Do payroll calculations

If you are currently using a HRM software, you can find fixed salaried staff’s wages in the system. Overtime and part-timers’ pay will be automatically calculated with the Payroll Attendance module.

Even CPF e-submission is one click away.

If you’re doing it manually, it’ll take a bit more time.

For contract staff, it’s pretty straight forward because salary is fixed.

For the others, calculating gross pay is as simple as adding up the hours they’ve worked. And multiply that by the employee’s hourly rate. Then, add up the overtime hours worked in the pay period and apply the employees’ overtime pay rate to those hours.

Step 5: Pay employees, tax agencies, benefit providers

Employers must pay salaries at least once a month, or at shorter intervals if they choose. Salaries must be paid within 7 days after the end of the salary period – non-payment of salary is an offence.

Taxes and benefit providers have their own due dates. And you generally have to pay these on a monthly basis.

Caution: Always check to ensure you have enough funds in your payroll bank account. Debiting more money than you have can result in unnecessary fines, delays and possibly legislative warnings.

You might be interested in: Deductible and non-deductibles for business tax

Step 6: Fix and report

Mistakes happen, but as long as you correct them quickly and honestly, you’ll be able to move forward. Also, make sure you have steps to prevent this mistake from happening again!

Many automated payroll software platforms like DashBod will give you downloadable reports. So you can be confident that everything is running smoothly and you are making the best decisions for your organization.

Step 7: Document and store your payroll records

In Singapore, employers are expected to keep two years of such records for all employees. Records of ex-employees must be kept for one year after they leave employment.

If you’re using software like DashBod, the documents are already online or can be uploaded and attached to the employee record.

That’s it. You did it. Congrats on doing payroll for your small business!

As your company grows and your employee profile becomes more diverse and complex, payroll processing could require more time and effort on your part.

If you are in a small to medium Singapore-based business, it’s time to start thinking ahead and hopping on a payroll system attached to your HRM software.