It’s that time of the year again. You need to file your Annual Returns and Corporate Income Tax Returns soon. You sigh to yourself, dreading the extra workload that adds to the mountain of tasks, all of which are due soon.

If this sounds familiar to you, it shouldn’t. The filing of your accounts should be an effortless process when you fully utilise the tools available.

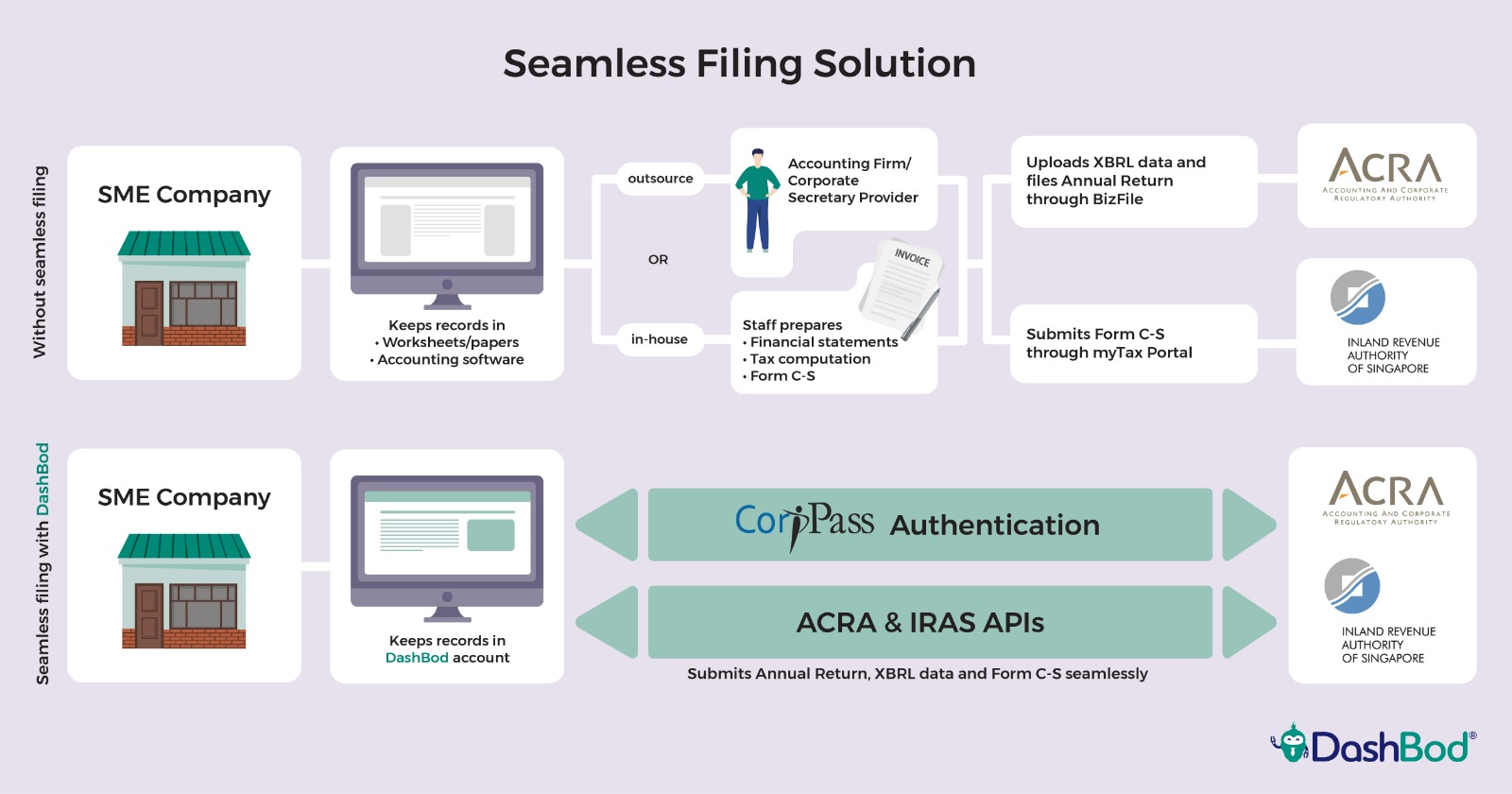

Here at DashBod, we are one of the two companies in Singapore that has seamless filing integrated in our software. It’s catered towards SMEs with straightforward tax affairs and accounting transactions and is just one of the many efforts to help SMEs stay relevant and competitive. ACRA and IRAS have partnered with us to create this solution, incorporating their required filing requirements all into one accounting software, making your job a whole lot easier.

It’s time to ditch manual filing along with those pens and papers, here’s why.

1. Automation

DashBod will automate the majority of your manual work. As this software is linked to both ACRA and IRAS systems, it eliminates the need to log into two separate portals to do the filings, namely ACRA’s Bizfile+ and IRAS’s myTax portal, thereby streamlining the entire process with this newfound convenience.

All you need to do is key in and consolidate business transactions and leave the rest to us. After you have input the data, DashBod will automatically convert source financial data into statutory filings. There will be back end authentication of end-users to ensure secure submission. Finally the filings will be directly submitted to the relevant agencies.

So hands off, DashBod is taking the wheel.

2. Saves Time

In turn, this saves you time, a lot of time. Companies can take up to a staggering 9 hours to perform manual filing. Using DashBod will help cut down that time to a speedy 30 minutes. This translates into time-saving of more than 90% for companies, thus freeing up time to do other tasks, improving efficiency and productivity.

Time saved can be spent on other tasks that further your business—for instance, clienteling. Building a good customer relationship is always something better done in person. That human touch makes it all the more special. It’s that connection, through a handshake, a smile or maybe talking business over a cup of coffee, whatever it is, it’s irreplaceable.

Dedicating more personal time for your customers shows them you care, and you do, don’t you?

3. Minimise Errors

In addition to a time save, incorporating this software would minimise the number of errors made. The filings are auto-generated using the accounting data embedded in the software and submitted directly to both ACRA and IRAS seamlessly, thereby eliminating human error.

Some of these errors are more common than one would think. Common accounting errors include:

- Data entry errors (mistakes that are made where and how items are entered in your accounting system)

- Error of omission (Failure to record an item)

- Error of omission (Mishandling of an item by putting it in the wrong place)

- Error of duplication (When you enter the same item of income or expense more than once)

No more careless mistakes to be re-visited and corrected in the books.

How secure is DashBod?

You might be wondering, is it safe to use such a software? What if the filing fails?

The way DashBod works is that it authenticates the Filings of Annual Returns and Corporate Taxes whereby companies need to log in using CorpPass. The entire filing process including CorpPass and payment of filing fees are linked to ACRA’s or IRAS’ systems via Application Programming Interfaces (APIs) which act as intermediaries that allow two applications to talk to each other. An acknowledgement for successful filings will be generated for companies to print/keep as a soft copy for record purposes.

Government Funding

Monetary incentives in the form of grants have been given to SMEs by our government to get a head start in going digital. Some of these grants offer a hefty payout to help your business digitise.

For example, the Start Digital Pack offered to SMEs embarking on their first steps to go digital. Should you choose this grant, consider yourself exempted from all costs using the accounting software for the first year, with a minimum 18-month contract period. Sign up for one year free DashBod subscription today!

Another grant offered is the Digital Resilience Bonus where SMEs in the F&B and retail sector can expect to receive payouts of up to S$10,000. On top of purchasing the accounting software, other conditions need to be met in order to be eligible. These include adopting PayNow Corporate, e-voicing and HR/Payroll software. You can find more information on IMDA’s website.

Am I Eligible To Use Dashbod?

There are a few more criteria your company needs to meet in order to use DashBod. Firstly, you may file with ACRA using DashBod only if your company:

1.Has revenue of S$500,000 or less for the current financial year

2.Has total assets of S$500,000 or less at financial year-end and

3. The company is not:

-

- listed or is in the process of issuing its debt or equity instruments for trading on a securities exchange in Singapore;

- listed on a securities exchange outside Singapore; and

- a financial institution

A company can file tax returns to IRAS using the accounting software if it meets the following conditions:

1.The company must qualify to file Form C-S, i.e.

- incorporated in Singapore;

- has an annual revenue of $5 million or below in the preceding financial year;

- derives income taxable at prevailing corporate tax rate of 17%;

2.Not claiming or utilising carry-back of current year capital allowance or losses, group relief, investment allowance or foreign tax credit and tax deducted at source;

3.The company maintains Singapore dollar as its functional and presentation currency;

4.The company is not an investment holding company or a service company that provides only related party services; and

5.The company does not own subsidiaries, associates or joint ventures, and has no investment in intangibles.

With more benefits than I can count with my fingers, what are you waiting for? Digitalise and keep up with the times! We hope you choose us as your partner and may we embark on this exciting journey in this digital age together.

You might be interested in: [Case Study] How an online accounting software saved this small business